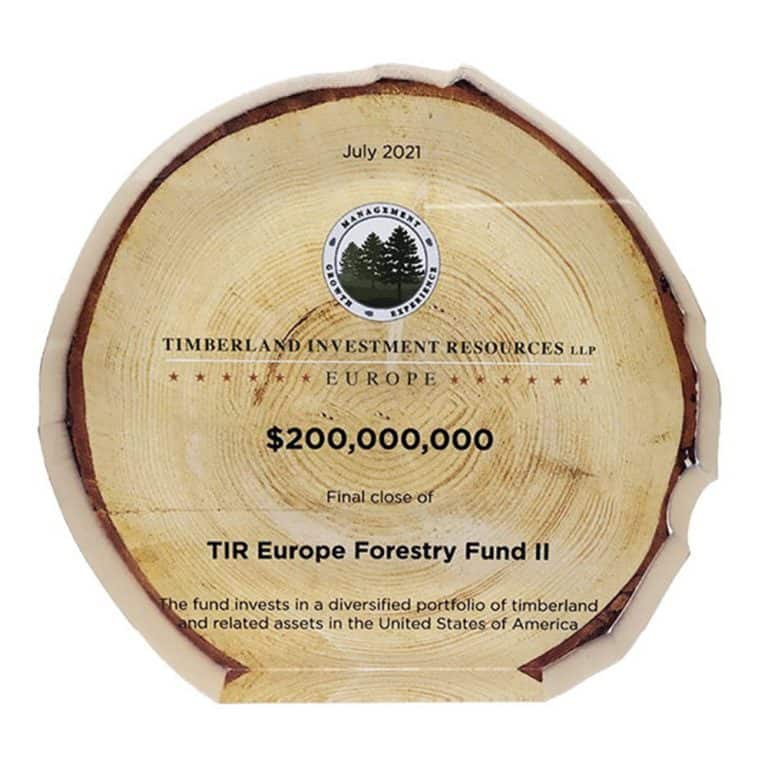

Beginning with the gallery on this page, you’ll find a selection of designs as diverse as the funds they represent. You’ll see here, for instance:

- A custom crystal marking the close of the inaugural fundraising phase for Blackstone Infrastructure Partners.

- A crystal tombstone recognizing the launch of a San Francisco-based, climate tech-centered fund.

- A Lucite commemorative celebrating the launch of a Finnish commercial real estate fund.

- A custom design commemorating the launch of a fund focused on early-stage healthcare start-ups.

- A custom Lucite recognizing the close of a fund devoted to mid-market investment opportunities in Spain.

Fund Closing Commemoratives and The Corporate Presence

The Corporate Presence brings unmatched expertise in commemorating fund closings. Our experience extends to funds representing a range of geographic areas, sectors, asset classes, and defining missions.

We can guide you to commemoratives that will truly resonate with all your fund’s stakeholders. Whether you’re looking for closing gift ideas for investors or custom designed awards, we have the perfect solution for you.

Explore our range of fund closing deal toys, custom Lucite embedments, deal cubes, and custom awards.

Get the creative process started.